he American Petroleum Institute (API) on Tuesday reported a build in crude oil inventories of 620,000 barrels for the week ending May 14.

Analysts had predicted a build of 1.680 million barrels for the week.

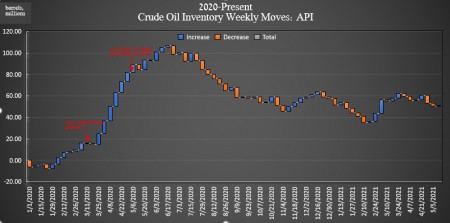

In the previous week, the API reported a massive draw in oil inventories of 2.533 million barrels after analysts had predicted a draw of 2.817 million barrels. Since the start of 2020, crude oil inventories have grown by more than 50 million barrels, according to API data.

Oil prices were trading down on the day prior to the data release as the market is particularly jittery when it was suggested that “important news” would be released on Wednesday regarding the Iranian nuclear deal, the resolution of which could result in more Iranian oil barrels hitting the market. A clarification was later made by Mikhail Ulyanov, Russia’s envoy to the JCPOA talks, saying that it was still “too early for a breakthrough”.

Even the notion that more Iranian oil could hit the markets was enough to send oil prices crashing.

At 1:30 p.m. EDT, WTI was trading at $65.18, or 1.64% down on the day not much changed since this time last week. Brent crude traded down at $68.41 per barrel or 1.40% down on the day.

While crude oil inventories fell this week, U.S. oil production was up 100,000 bpd at 11 million bpd on average for the week ending May 7, according to the latest data from the Energy Information Administration.

The API reported a draw in gasoline inventories of 2.837 million barrels for the week ending May 14—partially offsetting the previous week’s 5.640-million-barrel build. Analysts had expected a 886,000 barrel draw for the week.

Distillate stocks saw a decrease in inventories this week of 2.581 million barrels for the week, after last week’s 872,000-barrel decrease.

Cushing inventories rose this week by 53,000 barrels.

Post data release, at 4:41 p.m. EDT, the WTI benchmark was trading at $65.43 while Brent crude was trading at $68.65 per barrel—flat on the week.