Europe’s biggest gas pipeline operator, Italy-based Snam is crafting a bid for a piece of Energy Transfer Partner’s $6 billion natural gas pipeline, Reuters sources said on Friday.

If successful, it would not only be Snam’s first US project, but it also be its first project outside Europe, as the US natural gas industry is going gangbusters.

Snam is now conducting due diligence on buying a 33% stake, sold by ETP for the Rover pipeline, according to Reuters.

Despite all the controversy surrounding oil and gas pipelines in North America—both in the United States and Canada, they remain an attractive investment.

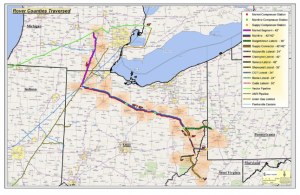

The Rover Pipeline travels a distance of 713 miles, starting in Southeastern Ohio, Western West Virginia, and Southwestern Pennsylvania, and then continues west through Ohio and then north into Michigan, according to Roverpipelinefacts.

The pipeline has the capacity to move 3.25 billion cubic feet per day, transporting gas from the Marcellus and Utica.

Rumors first surfaced that ETP was considering a sale of its 33% stake in the pipeline project in mid-July. At the time, it was thought that such a sale would net ETP $2.5 billion, according to Bloomberg. ETP has already ditched a 32% stake in Rover to Blackstone for $1.57 billion at a time when the pipeline, then just under construction, faced possible delays over environmental scrutiny and even some environmental-related work stoppages and lawsuits.

The pipeline has done much to relieve the bottlenecks in the Utica and Marcellus regions, and has increased natural gas production in the area through the relief of some of these bottlenecks. Also relieving the transportation bottlenecks in the area are the NEXUS and Williams’ Atlantic Sunrise pipelines.