The American Petroleum Institute (API) has estimated a crude oil inventory draw of 3.72 million barrels for the week ending November 28, compared to analyst expectations of a 1.798-million-barrel draw in inventory—the biggest draw since September.

Last week saw a build in crude oil inventories of 3.639 million barrels, according to API data. The EIA’s estimates, however, reported a smaller build of 1.6-million barrels for that week.

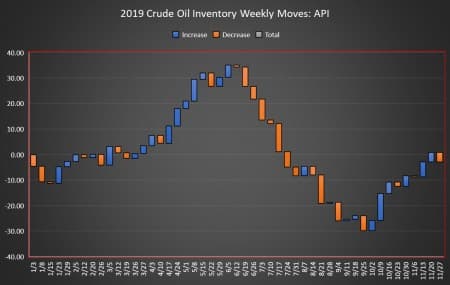

After today’s reported inventory move, the net inventory moves so far this year stand at a draw of 2.98 million barrels for the 49-week reporting period so far, using API data.

WTI spot prices were trading up on Tuesday prior to the data release despite disappointing trade negotiation news courtesy of President Trump. At 12:12pm EST, WTI was trading up 0.13% (+$0.07) at $56.03—more than $2 per barrel lower than last week’s levels.

WTI spot prices were trading up on Tuesday prior to the data release despite disappointing trade negotiation news courtesy of President Trump. At 12:12pm EST, WTI was trading up 0.13% (+$0.07) at $56.03—more than $2 per barrel lower than last week’s levels.

The price of a Brent barrel, on the other hand, was trading slightly down, by $0.02 (-0.03%) at that time, at $60.90—also roughly $2 per barrel down from last week.

The API this week reported a build of 2.93 million barrels of gasoline for week ending November 28, compared to analyst expectations of a build in gasoline inventories of 1693-million barrels for the week.

Distillate inventories saw a build of 794,000 barrels for the week, while Cushing inventories fell by 251,000 barrels.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending November 22 climbed to another brand new high for the week of 12.9 million bpd—more than 1 million bpd over the daily average production at the beginning of the year.

At 4:40pm EDT, WTI was trading at $56.27, while Brent was trading at $60.96.